Let MJV Innovate your Insurance Business

20+ years helping insurance companies transform and succeed through utilizing a combination of a human-centered approach, agile methodology, data science, and technology.

20+ years helping insurance companies transform and succeed through utilizing a combination of a human-centered approach, agile methodology, data science, and technology.

Health

Insurance

Life & Pension

Insurance

Auto

Insurance

Property &

Casualty Insurance

MJV helped Santander restructure its auto insurance services into a frictionless platform with a 100% digital contracting journey.

MJV was tasked with building an AI model to detect possible fraudulent account applications for the client's Mobile Payment System

A Global Insurance Group Completely Redesigned their Communications to Become More Transparent and Improve Customer Experience.

Let us help solve your insurance challenges!

New Business Analytics solutions are changing the paradigms of the insurance market. Cultivating a data-driven culture needs to be prioritized for a scalable business model focused on data processing and analysis. Through this, we can make conscious decisions, format custom products, and services, and ensure cost optimization with today’s tools.

Digital Transformation has promoted significant changes in companies, ranging from optimizing internal processes and improving customer relationships to developing new business models. In this context, open innovation allows conservative sectors to update more agile and uncomplicated, such as the insurance market.

Find out how MJV is helping its top Insurance clients transform their business through a combination of human-centered and agile approaches, data science and technology.

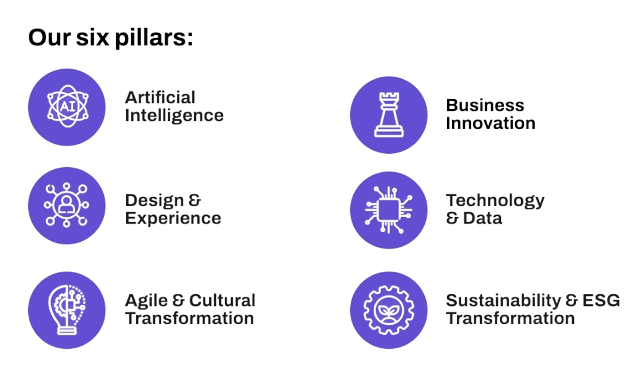

MJV Technology & Innovation is a global consulting firm that leverages AI to drive business growth, foster innovation, and solve complex challenges for some of the world’s largest companies.

29 years of experience.

Choosing a business partner is not a decision we make lightly.

We have the utmost confidence in their experience, knowledge, and ability to deliver.

.png)